/ Places & Palates

Japan Airlines expands network plan for March-May 2022

/ The Filipino Lifestyle

14 on 14: Cebu Bloggers Society celebrates 14 years!

/ The Weekly Char

What Topped the Recap: Yahoo’s Year in Review 2021 Philippines

/ Monette's Musings

Celebrating Diwali, Festival of Lights

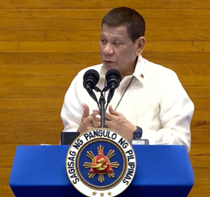

/ State Affairs

Comelec extends deadline for voter registration to October 30

/ The Red Board

President Rodrigo Roa Duterte State of the Nation Address 2021

/ Monette's Musings

Driving holistic health in the IT-BPM industry

/ Places & Palates

Spending a weekend in Singapore (Taylor’s Version)

/ Community Watch

DSWD looking to upscale FDS to help eradicate tuberculosis

/ Be Bright

Nurturing employee well-being in the new year

/ Tech Inside

Why data security matters in an ever-evolving landscape

/ Places & Palates

Art to eat, coming right up!

/ The Filipino Lifestyle

Starting a bucket list? Here are must-try activities for the lover of the outdoors

/ The Weekly Char

10 things that will turn 10 this year